Cumulative Effects Impairment and the Disability Tax Credit

The DTC accounts for multiple impairments that together significantly restrict daily activities

Eligibility Criteria:

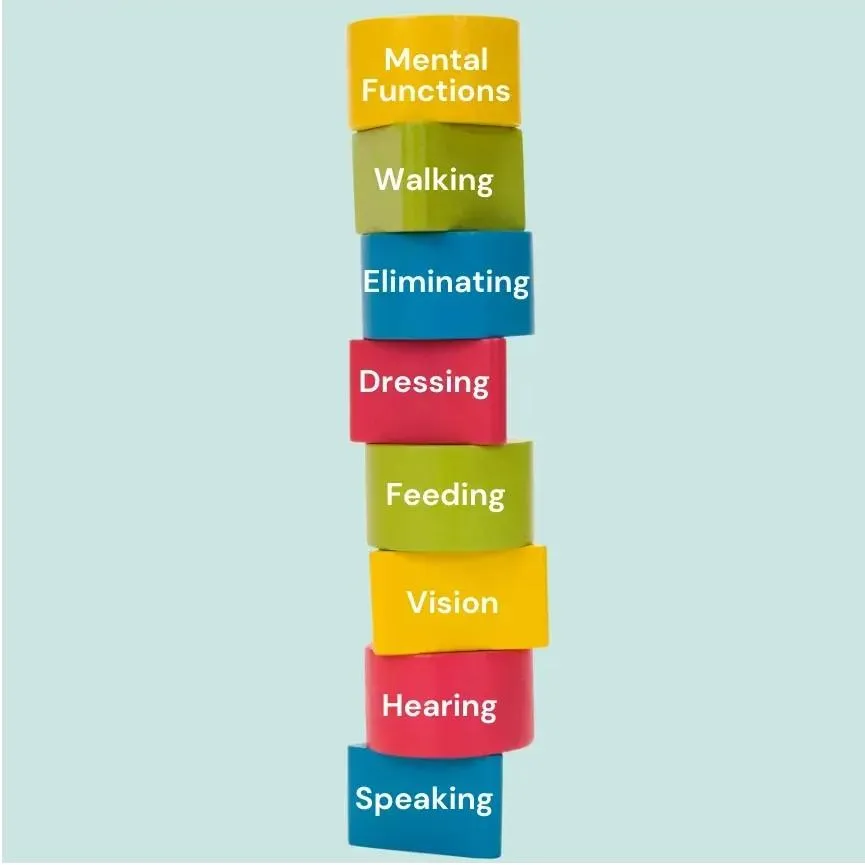

You have limitations in 2 or more of the cumulative effect categories pictured to the right

When your limitations are combined, their overall impact would be like being unable to do an activity or taking three times longer than someone your age without the impairment

The two or more limitations are present together almost all the time, about 90% or more even when using therapy, medication or devices

Your limitations have lasted or are expected to last for a continuous period of at least 12 months

Common Qualifying Conditions:

Vision and mobility impairments together

Two or more mobility impairments together

Mental and physical impairments combining to limit daily functioning

Medical Certification:

Must be certified by a medical doctor, nurse practitioner or an occupational therapist provided they are only certifying limitations for walking, feeding, and dressing